Is the Photosensitive Polyimide Coating Market a Strategic Investment Choice for 2025–2033 ?

Photosensitive Polyimide Coating Market – Research Report (2025–2033) delivers a comprehensive analysis of the industry’s growth trajectory, with a balanced focus on key components: historical trends (20%), current market dynamics (25%), and essential metrics including production costs (10%), market valuation (15%), and growth rates (10%)—collectively offering a 360-degree view of the market landscape. Innovations in Photosensitive Polyimide Coatings+A2:AD4 Market Size, Share, Growth, and Industry Analysis, By Type (Positive Photosensitive Polyimide,Negative Photosensitive Polyimide), By Application (Display Panel,Electronic Packaging,Printed Circuit Board), Regional Insights and Forecast to 2033 are driving transformative changes, setting new benchmarks, and reshaping customer expectations.

These advancements are projected to fuel substantial market expansion, with the industry expected to grow at a CAGR of 24.3% from 2025 to 2033.

Our in-depth report—spanning over 88 Pages delivers a powerful toolkit of insights: exclusive insights (20%), critical statistics (25%), emerging trends (30%), and a detailed competitive landscape (25%), helping you navigate complexities and seize opportunities in the Chemicals & Materials sector.

Global Photosensitive Polyimide Coatings market size is estimated at USD 634.71 million in 2024, set to expand to USD 4491.54 million by 2033, growing at a CAGR of 24.3%.

The Photosensitive Polyimide Coating market is projected to experience robust growth from 2025 to 2033, propelled by the strong performance in 2024 and strategic innovations led by key industry players. The leading key players in the Photosensitive Polyimide Coating market include:

- Toray

- HD Microsystems

- SK Materials

- Asahi Kasei

- Fujifilm Electronic Material

Request a Sample Copy @ https://www.marketgrowthreports.com/enquiry/request-sample/103169

Emerging Photosensitive Polyimide Coating market leaders are poised to drive growth across several regions in 2025, with North America (United States, Canada, and Mexico) accounting for approximately 25% of the market share, followed by Europe (Germany, UK, France, Italy, Russia, and Turkey) at around 22%, and Asia-Pacific (China, Japan, Korea, India, Australia, Indonesia, Thailand, Philippines, Malaysia, and Vietnam) leading with nearly 35%. Meanwhile, South America (Brazil, Argentina, and Colombia) contributes about 10%, and the Middle East & Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South Africa) make up the remaining 8%.

Photosensitive Polyimide Coatings Market Trends

The photosensitive polyimide coatings market is witnessing several notable trends. The increasing miniaturization of electronic devices has led to a surge in demand for coatings that can provide precise patterning and high-resolution capabilities. Negative photosensitive polyimide coatings, known for their excellent thermal stability and chemical resistance, are increasingly preferred in applications such as semiconductor packaging and flexible printed circuits. In 2023, negative PSPI accounted for approximately 60% of the market share.

Another trend is the growing application of these coatings in display panels, particularly with the rise of flexible and foldable electronic devices. Display panels constitute nearly 45% of the global usage of photosensitive polyimide coatings. The demand for lightweight and durable materials in next-generation devices further propels this trend. Additionally, advancements in lithographic techniques have enhanced the resolution and performance of polyimide coatings, enabling more precise patterning in electronic components. The development of new photosensitive compounds has also contributed to improved product performance.

The market is also influenced by regional dynamics. Asia-Pacific, particularly countries like China, Japan, and South Korea, dominates the market due to rapid industrialization and significant investments in the semiconductor sector. Europe and North America are also key regions, with Europe attracting around USD 100 billion in semiconductor industry investments as of July 2023.

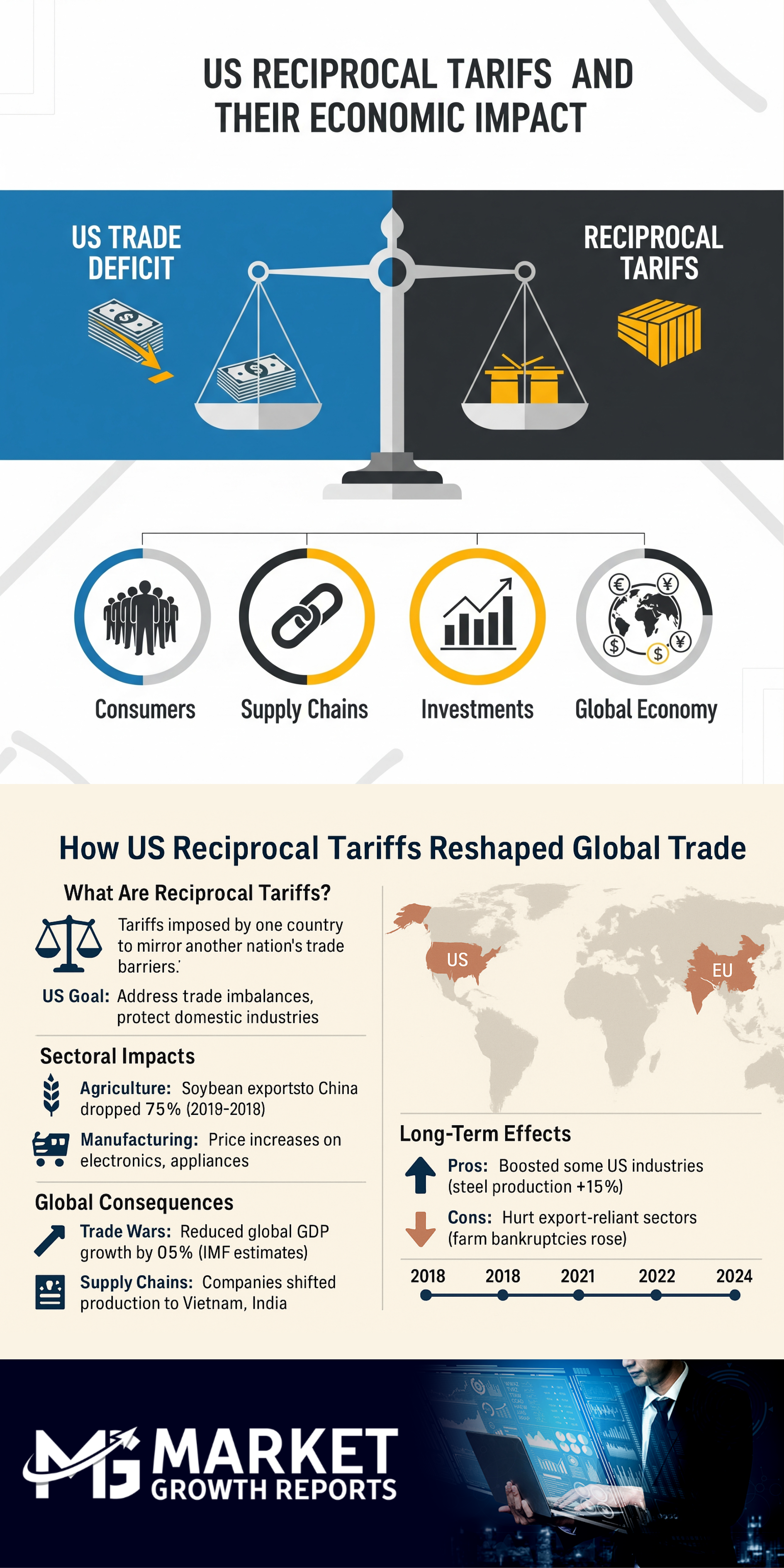

United States Tariffs: A Strategic Shift in Global Trade

In 2025, the U.S. implemented reciprocal tariffs on 70 countries under Executive Order 14257. These tariffs, which range from 10% to 50%, were designed to address trade imbalances and protect domestic industries. For example, tariffs of 35% were applied to Canadian goods, 50% to Brazilian imports, and 25% to key products from India, with other rates on imports from countries like Taiwan and Switzerland.

The immediate economic impact has been significant. The U.S. trade deficit, which was around $900 billion in recent years, is expected to decrease. However, retaliatory tariffs from other countries have led to a nearly 15% decline in U.S. agricultural exports, particularly soybeans, corn, and meat products.

U.S. manufacturing industries have seen input costs increase by up to 12%, and supply chain delays have extended lead times by 20%. The technology sector, which relies heavily on global supply chains, has experienced cost inflation of 8-10%, which has negatively affected production margins.

The combined effect of these tariffs and COVID-19-related disruptions has contributed to an overall slowdown in global GDP growth by approximately 0.5% annually since 2020. Emerging and developing economies are also vulnerable, as new trade barriers restrict their access to key export markets.

While the U.S. aims to reduce its trade deficit, major surplus economies like the EU and China may be pressured to adjust their domestic economic policies. The tariffs have also prompted legal challenges and concerns about their long-term effectiveness. The World Trade Organization (WTO) is facing increasing pressure to address the evolving global trade environment, with some questioning its role and effectiveness.

About Us: Market Growth Reports is a unique organization that offers expert analysis and accurate data-based market intelligence, aiding companies of all shapes and sizes to make well-informed decisions. We tailor inventive solutions for our clients, helping them tackle any challenges that are likely to emerge from time to time and affect their businesses.