Is the Luxury Bathroom Plumbing Fixtures Market a Strategic Investment Choice for 2025–2033 ?

Luxury Bathroom Plumbing Fixtures Market – Research Report (2025–2033) delivers a comprehensive analysis of the industry’s growth trajectory, with a balanced focus on key components: historical trends (20%), current market dynamics (25%), and essential metrics including production costs (10%), market valuation (15%), and growth rates (10%)—collectively offering a 360-degree view of the market landscape. Innovations in Luxury Bathroom Plumbing Fixtures Market Size, Share, Growth, and Industry Analysis, By Type (Toilet,Sink,Shower,Tub,Others), By Application (Commercial,Household), Regional Insights and Forecast to 2033 are driving transformative changes, setting new benchmarks, and reshaping customer expectations.

These advancements are projected to fuel substantial market expansion, with the industry expected to grow at a CAGR of 10% from 2025 to 2033.

Our in-depth report—spanning over 89 Pages delivers a powerful toolkit of insights: exclusive insights (20%), critical statistics (25%), emerging trends (30%), and a detailed competitive landscape (25%), helping you navigate complexities and seize opportunities in the Consumer Goods sector.

Global Luxury Bathroom Plumbing Fixtures market size is projected at USD 118035.5 million in 2024 and is anticipated to reach USD 281839.25 million by 2033, registering a CAGR of 10%.

The Luxury Bathroom Plumbing Fixtures market is projected to experience robust growth from 2025 to 2033, propelled by the strong performance in 2024 and strategic innovations led by key industry players. The leading key players in the Luxury Bathroom Plumbing Fixtures market include:

- Toto Ltd.

- Kohler

- Lixil Group

- Fortune Brands

- Masco

- Dornbracht

- Bradley Corporation

- Spectrum Brands Holdings Incorporated(Pfister)

- Gerber

- Aquabrass

- Symmons

- Vigo Industrie

Request a Sample Copy @ https://www.marketgrowthreports.com/enquiry/request-sample/103168

Emerging Luxury Bathroom Plumbing Fixtures market leaders are poised to drive growth across several regions in 2025, with North America (United States, Canada, and Mexico) accounting for approximately 25% of the market share, followed by Europe (Germany, UK, France, Italy, Russia, and Turkey) at around 22%, and Asia-Pacific (China, Japan, Korea, India, Australia, Indonesia, Thailand, Philippines, Malaysia, and Vietnam) leading with nearly 35%. Meanwhile, South America (Brazil, Argentina, and Colombia) contributes about 10%, and the Middle East & Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South Africa) make up the remaining 8%.

Luxury Bathroom Plumbing Fixtures Market Trends

The shift toward touchless and smart technologies fueled strong demand, with 75 percent of luxury hotels and 42 percent of residential projects installing sensor‑activated faucets in 2023—up from 48 percent and 30 percent respectively in 2021. Industry R&D led to 22 new smart faucet models, capturing 12 percent of total luxury unit sales. Simultaneously, sustainable materials saw a 28 percent uptick: 8.4 million units of water‑saving fixtures shipped, reflecting consumer focus on eco‑efficiency.

Customization deepened, as 65 percent of high‑end renovations included bespoke designs, compared to 50 percent in 2020. Luxury fixture manufacturers launched 18 co‑brand collections with interior designers, accounting for 9 percent of new product introductions. The rise of e‑commerce accelerated: 38 percent of luxury fixtures sold through online channels in 2023, versus 24 percent in 2021. This shift drove logistics partnerships, with major distributors expanding warehousing by 27 percent, adding 35 new fulfillment centers globally.

Demand from premium real‑estate propelled installations in newly built homes: 1.2 million luxury bathroom units were installed in upscale residential developments, up 21 percent from 990,000 units in 2021. Commercial projects also surged, with 800 luxury hotel and resort bathrooms completed, a 19 percent increase over 672 in 2021. In the retrofit arena, 2,400 luxury home remodels were executed, marking a 14 percent year‑over‑year rise from 2,100 renovations.

Technological convergence emerged as a clear trend: integrated digital controls appeared in 14 million luxury fixtures, comprising 39 percent of all high‑end unit sales. Voice‑activation and app‑enabled showers captured 7.5 million units. Manufacturers invested in capacity expansions, raising annual output by 21 percent to 43.6 million units. These trends reflect a market prioritizing innovation, sustainability and personalized experiences.

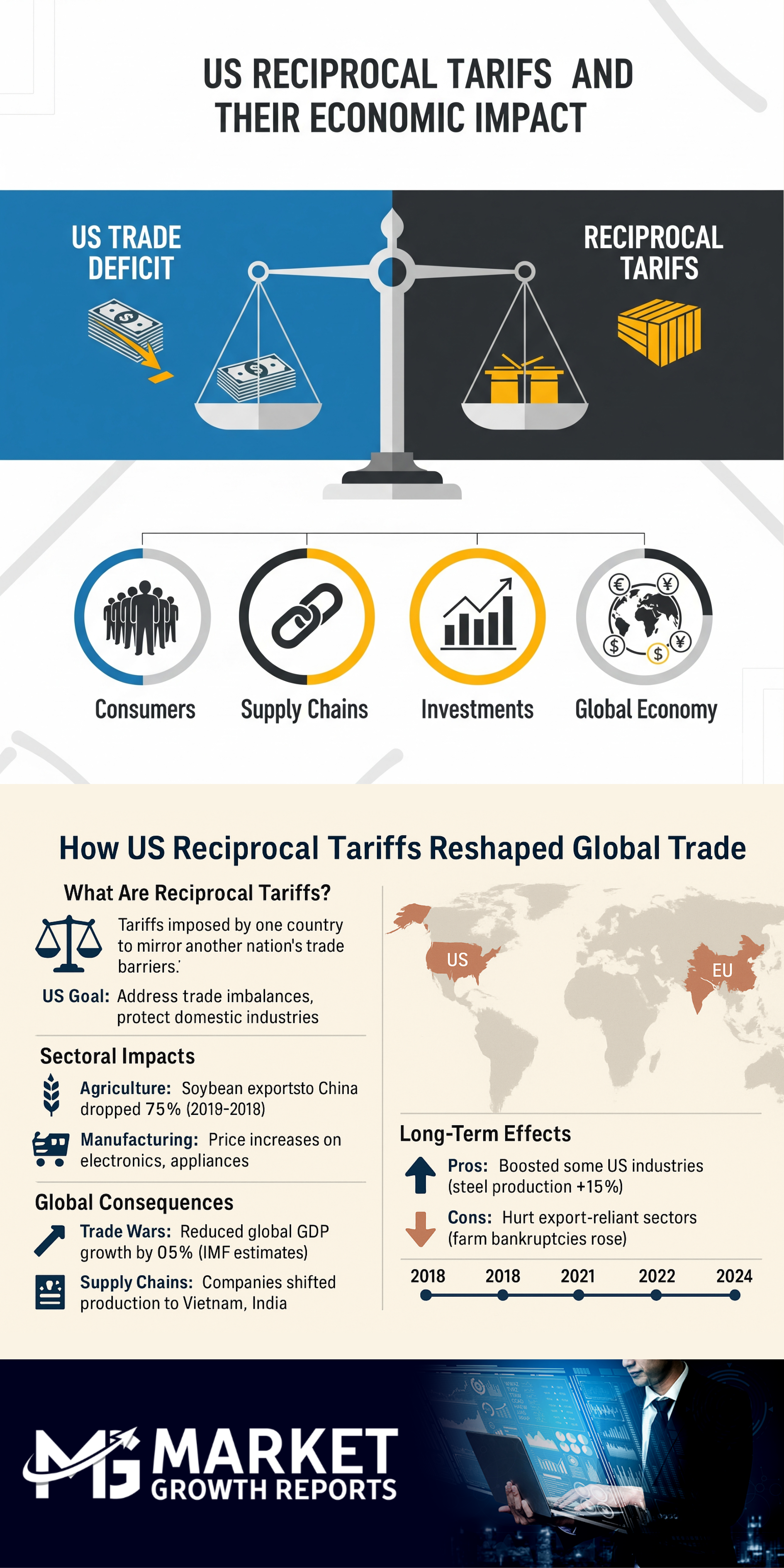

United States Tariffs: A Strategic Shift in Global Trade

In 2025, the U.S. implemented reciprocal tariffs on 70 countries under Executive Order 14257. These tariffs, which range from 10% to 50%, were designed to address trade imbalances and protect domestic industries. For example, tariffs of 35% were applied to Canadian goods, 50% to Brazilian imports, and 25% to key products from India, with other rates on imports from countries like Taiwan and Switzerland.

The immediate economic impact has been significant. The U.S. trade deficit, which was around $900 billion in recent years, is expected to decrease. However, retaliatory tariffs from other countries have led to a nearly 15% decline in U.S. agricultural exports, particularly soybeans, corn, and meat products.

U.S. manufacturing industries have seen input costs increase by up to 12%, and supply chain delays have extended lead times by 20%. The technology sector, which relies heavily on global supply chains, has experienced cost inflation of 8-10%, which has negatively affected production margins.

The combined effect of these tariffs and COVID-19-related disruptions has contributed to an overall slowdown in global GDP growth by approximately 0.5% annually since 2020. Emerging and developing economies are also vulnerable, as new trade barriers restrict their access to key export markets.

While the U.S. aims to reduce its trade deficit, major surplus economies like the EU and China may be pressured to adjust their domestic economic policies. The tariffs have also prompted legal challenges and concerns about their long-term effectiveness. The World Trade Organization (WTO) is facing increasing pressure to address the evolving global trade environment, with some questioning its role and effectiveness.

About Us: Market Growth Reports is a unique organization that offers expert analysis and accurate data-based market intelligence, aiding companies of all shapes and sizes to make well-informed decisions. We tailor inventive solutions for our clients, helping them tackle any challenges that are likely to emerge from time to time and affect their businesses.