Introduction

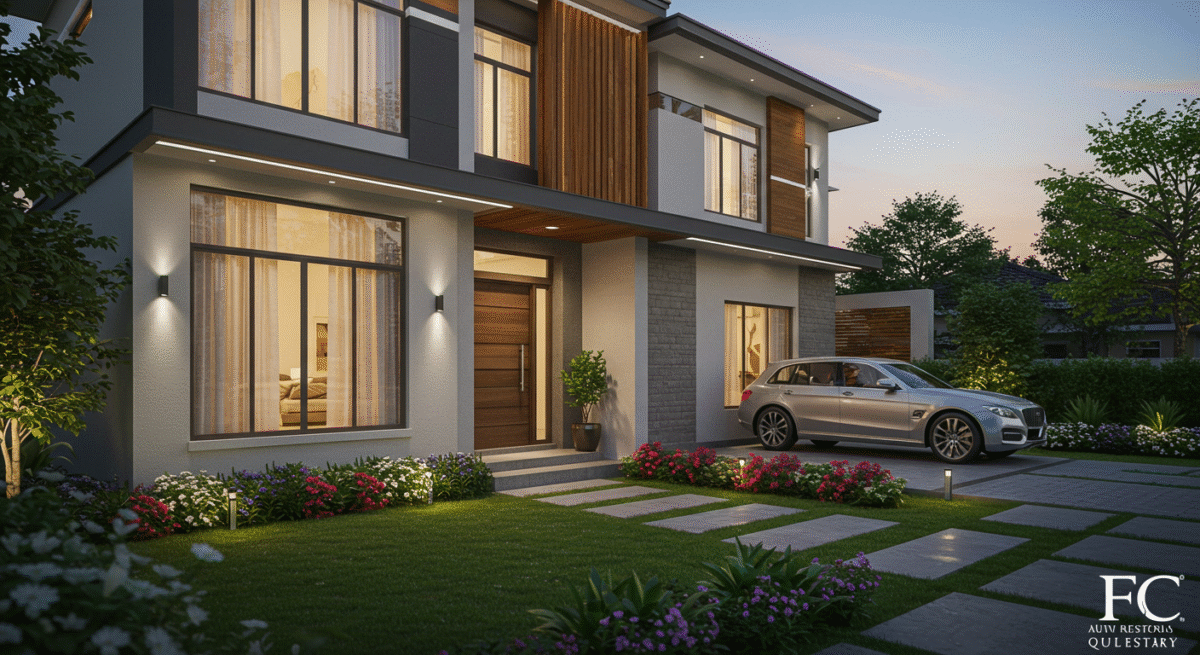

When it comes to making secure, profitable, and long-term investments, fcrealestate has emerged as a game-changer in the property market. Whether you’re an aspiring investor or a seasoned real estate professional, understanding the dynamics of fcrealestate can open doors to new opportunities. This in-depth guide covers everything — from market trends, property valuation, and financing strategies to risk management and portfolio growth. With related concepts like property investment, market analysis, real estate ROI, asset diversification, and commercial leasing playing an essential role, you’ll have a complete roadmap to navigate the ever-evolving business of fcrealestate.

Understanding the FCRealEstate Concept

The evolution of modern property investment

The term fcrealestate refers to a strategic, data-driven approach to property investment. Unlike conventional real estate transactions, which often depend on local market knowledge alone, fcrealestate uses advanced analytics, industry expertise, and financial modeling to identify lucrative opportunities. Over the last decade, property investment has evolved significantly, with globalization, technology, and flexible financing reshaping how investors operate.

Why FCRealEstate is different from traditional real estate

Traditional real estate deals often focus on immediate profits or single-property purchases. FCRealEstate, however, is about building a sustainable investment model that adapts to market fluctuations. It emphasizes portfolio diversification, risk mitigation, and leveraging market intelligence, making it a powerful strategy for long-term wealth creation.

Key Benefits of FCRealEstate for Investors

High ROI potential

Investors in fcrealestate often enjoy higher-than-average returns due to strategic property selection and effective management practices. By using market trend analysis and targeting emerging areas, investors can maximize appreciation and rental income.

Diverse property options

From luxury apartments and commercial spaces to mixed-use developments, fcrealestate offers a variety of property types. This diversity allows investors to tailor their portfolios to match their financial goals and risk appetite.

Market Trends Driving FCRealEstate Growth

Urban expansion and infrastructure development

Rapid urbanization and infrastructure investments are major drivers of fcrealestate growth. Cities are expanding, transportation networks are improving, and demand for both residential and commercial spaces is increasing.

Technological integration in property management

Digital tools such as property management software, blockchain for secure transactions, and AI-driven valuation models have revolutionized the fcrealestate sector. These technologies not only increase efficiency but also provide transparency and accuracy.

Essential Strategies for FCRealEstate Success

Location analysis and timing

In fcrealestate, location is more than just a buzzword. Investors must study market cycles, zoning laws, and neighborhood growth patterns. Entering the market at the right time can significantly impact ROI.

Leveraging professional networks

Networking with brokers, legal advisors, architects, and financial planners gives investors an edge in the fcrealestate market. Strong relationships can lead to better deals, insider opportunities, and faster transactions.

Financial Planning in FCRealEstate

Understanding financing options

From conventional bank loans to real estate crowdfunding, fcrealestate investors have a variety of financing choices. Understanding the pros and cons of each option ensures better financial stability.

Balancing debt and equity

Maintaining a healthy ratio of debt to equity is critical in fcrealestate. Too much leverage can increase risks, while too little can limit potential returns. Successful investors strike a strategic balance.

Risk Management in FCRealEstate Investments

Identifying potential risks early

Economic downturns, interest rate hikes, and market oversupply can impact fcrealestate performance. Proactive risk assessments help mitigate potential losses before they occur.

Building a diversified portfolio

Diversification across asset types and locations is a proven method to minimize fcrealestate risks. This approach ensures that downturns in one sector are offset by gains in another.

The Role of Technology in FCRealEstate

AI and big data in property valuation

Advanced algorithms can process thousands of data points to determine accurate property values in the fcrealestate sector. This minimizes guesswork and helps in making informed decisions.

Virtual tours and online transactions

With virtual reality and secure online payment systems, fcrealestate transactions are faster, safer, and more accessible to global investors.

Future Outlook of FCRealEstate

Global market influence

International buyers, foreign direct investment, and cross-border financing are shaping the fcrealestate landscape. Global economic conditions will continue to influence trends.

Sustainability and eco-friendly developments

Green buildings and sustainable infrastructure are becoming central to fcrealestate projects. Eco-friendly practices not only reduce environmental impact but also attract socially conscious investors.

For more infomation “Property fair Serena Hotel“

Conclusion – Why FCRealEstate Should Be Your Next Move

In a rapidly changing economic climate, fcrealestate offers a forward-thinking, resilient approach to property investment. With its blend of technology, market intelligence, and strategic planning, it provides investors with a competitive edge. Whether you’re diversifying your portfolio or seeking high-yield opportunities, fcrealestate is a powerful vehicle for long-term financial growth.

FAQs About FCRealEstate

1. What is FCRealEstate?

FCRealEstate refers to a modern, data-driven approach to property investment that emphasizes strategy, diversification, and market analysis.

2. How can I start investing in FCRealEstate?

Begin by researching markets, setting clear financial goals, and consulting professionals who specialize in fcrealestate.

3. Is FCRealEstate suitable for beginners?

Yes, beginners can enter the fcrealestate market with the right guidance, education, and financing strategy.

4. What makes FCRealEstate different from traditional real estate?

Unlike traditional real estate, fcrealestate focuses on analytics, technology integration, and long-term portfolio management.

5. Can FCRealEstate investments be done internationally?

Absolutely. Many fcrealestate investors diversify globally to access emerging markets and maximize returns.