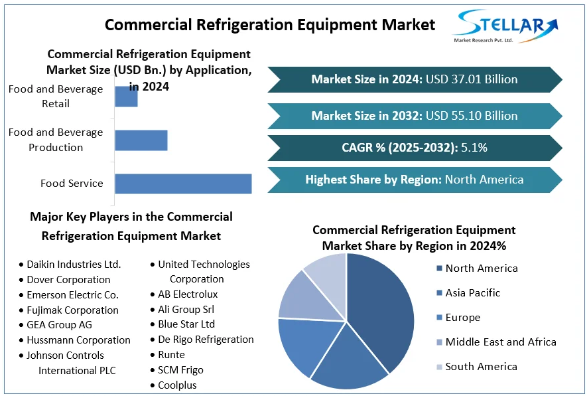

Commercial Refrigeration Equipment Market size was valued at US$ 37.01 Bn. in 2024 and the total Commercial Refrigeration Equipment Market revenue is expected to grow at a CAGR of 5.1% from 2025 to 2032, reaching nearly USD 55.10 Bn.

Market Estimation & Definition

Definition:

Commercial refrigeration equipment refers to cooling systems used in commercial environments such as supermarkets, restaurants, hospitals, and food processing facilities. These include refrigerators, freezers, refrigerated display cases, transport refrigeration units, beverage coolers, and walk-in cold rooms.

Market Estimations:

-

2023 Value: ~USD 40.8 billion

-

2024 Estimate: USD 49.3 billion

-

2032 Forecast: USD 74 billion

-

CAGR (2025–2032): 5.3%

This growth highlights the global shift toward more sustainable, digitized, and adaptable refrigeration infrastructure across the retail and hospitality landscape.

Market Growth Drivers & Opportunity

a) Growth in Food Retail & Cold Chain Infrastructure

An increase in hypermarkets, convenience stores, and cloud kitchens has pushed demand for commercial refrigeration. Additionally, cold storage and logistics facilities are expanding rapidly to support the booming online grocery and meal delivery economy.

b) Regulatory Push for Energy Efficiency

Governments in North America and Europe have introduced stringent regulations to reduce energy consumption and promote environmentally friendly refrigerants. Compliance mandates are prompting widespread upgrades in commercial equipment.

c) Natural Refrigerant Adoption

Global shifts away from hydrofluorocarbons (HFCs) are encouraging the use of sustainable refrigerants such as carbon dioxide (CO₂) and hydrocarbons. This transformation is both a challenge and an opportunity for manufacturers.

d) Modular and Smart Systems

Retailers and foodservice operators are increasingly deploying modular plug-in refrigeration systems for ease of installation, energy management, and maintenance. The rise of IoT-enabled solutions enables real-time monitoring and preventive maintenance, reducing total cost of ownership.

e) Food Safety and Preservation

Stricter regulations around food safety and temperature control, especially in pharmaceuticals and perishable foods, are propelling demand for high-precision, sensor-enabled refrigeration equipment.

Segmentation Analysis

By Product Type:

-

Refrigerators & Freezers: Account for a substantial market share due to demand from supermarkets and food chains.

-

Refrigerated Display Cases: Widely used in retail, these units hold nearly half the product segment share.

-

Transport Refrigeration: Poised for significant growth driven by logistics and supply chain modernization.

By Refrigerant Type:

-

Fluorocarbons: Still dominate but are gradually declining due to environmental restrictions.

-

Hydrocarbons & CO₂: Expected to witness fast adoption, especially in developed markets with green mandates.

By Application:

-

Supermarkets & Hypermarkets: Continue to dominate usage due to extensive need for both storage and display solutions.

-

Hotels, Restaurants, and Cafés (HoReCa): Growing rapidly due to expansion in hospitality and tourism.

-

Healthcare & Pharma: Increasing demand for temperature-controlled storage of sensitive drugs and vaccines.

By Configuration Type:

-

Plug-in Units: Gaining popularity due to ease of use and installation. Ideal for small and mid-sized retailers.

-

Remote Systems: Still prevalent in large stores with high cooling loads.

-

Walk-in Coolers/Freezers: Essential for bulk storage in food service and food processing sectors.

By Region:

-

North America: Maintains a leading share driven by regulatory compliance and energy transition.

-

Asia-Pacific: The fastest-growing region owing to urbanization, food retail expansion, and economic growth.

-

Europe: A mature market focused on sustainability and refrigerant transitions.

Country-Level Analysis: USA & Germany

United States:

The U.S. is a dominant player in the commercial refrigeration equipment landscape, driven by strong demand from retail giants, convenience chains, and restaurant operators. With the Department of Energy (DOE) introducing new energy-efficiency standards, there’s a pressing need for manufacturers and users to upgrade legacy systems.

Key factors:

-

Large-scale food retail operations

-

Strong investment in cold-chain infrastructure

-

Rising adoption of IoT-integrated refrigeration

-

Government incentives for energy-efficient upgrades

Germany:

Germany is among the top-performing markets in Europe. Stringent environmental regulations under the EU’s F-gas directive are accelerating the adoption of natural refrigerants and high-efficiency cooling systems.

Key trends:

-

Rapid retrofit of supermarket refrigeration using CO₂ and hydrocarbon systems

-

Presence of leading global OEMs with R&D centers

-

High market maturity in retail refrigeration

-

Strong focus on modular, sustainable, and silent operation units

Commutator Analysis (Porter’s Five Forces)

Competitive Rivalry – High

The commercial refrigeration equipment market is highly competitive, with numerous international players offering differentiated technologies and energy-efficient solutions. Companies compete on technology, pricing, service, and sustainability.

Threat of New Entrants – Moderate

While established players benefit from economies of scale and brand recognition, the market is open to innovation-led new entrants, especially in modular systems and smart refrigeration technologies.

Bargaining Power of Suppliers – Moderate

Suppliers of key components such as compressors, sensors, and eco-friendly refrigerants hold moderate influence. Global sourcing and competition limit supplier dominance, but raw material pricing remains a key factor.

Bargaining Power of Buyers – Moderate to High

Large retail chains and foodservice franchises possess significant bargaining power. They often demand customized, efficient, and regulation-compliant systems, especially in North America and Europe.

Threat of Substitutes – Low to Moderate

Although no direct substitutes exist for refrigeration, businesses are evaluating passive cooling solutions and low-tech alternatives in limited rural or cost-sensitive environments. However, in most urban and regulated markets, substitution risk remains minimal.

Conclusion

The commercial refrigeration equipment market is undergoing a substantial transformation. What was once a volume-driven industry is now defined by efficiency, intelligence, and environmental stewardship. The transition to smart, low-GWP refrigerant-based systems is no longer optional—it’s imperative.

With a projected market value of USD 74 billion by 2032, businesses across retail, foodservice, healthcare, and logistics are gearing up for a new era of refrigeration—one that is clean, connected, and customer-focused.

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

+91 20 6630 3320, +91 9607365656