Is the C-MET & HGF Inhibitors Market a Strategic Investment Choice for 2025–2033 ?

C-MET & HGF Inhibitors Market – Research Report (2025–2033) delivers a comprehensive analysis of the industry’s growth trajectory, with a balanced focus on key components: historical trends (20%), current market dynamics (25%), and essential metrics including production costs (10%), market valuation (15%), and growth rates (10%)—collectively offering a 360-degree view of the market landscape. Innovations in C-MET & HGF Inhibitors Market Size, Share, Growth, and Industry Analysis, By Type (Cabozantinib,Crizotinib,Others), By Application (Hospital,Drug Store), Regional Insights and Forecast to 2033 are driving transformative changes, setting new benchmarks, and reshaping customer expectations.

These advancements are projected to fuel substantial market expansion, with the industry expected to grow at a CAGR of 23.9% from 2025 to 2033.

Our in-depth report—spanning over 126 Pages delivers a powerful toolkit of insights: exclusive insights (20%), critical statistics (25%), emerging trends (30%), and a detailed competitive landscape (25%), helping you navigate complexities and seize opportunities in the Healthcare sector.

Global C-MET & HGF Inhibitors market size is anticipated to be worth USD 4436.19 million in 2024, projected to reach USD 30512.15 million by 2033 at a 23.9% CAGR.

The C-MET & HGF Inhibitors market is projected to experience robust growth from 2025 to 2033, propelled by the strong performance in 2024 and strategic innovations led by key industry players. The leading key players in the C-MET & HGF Inhibitors market include:

- Exelixis

- Ipsen

- Pfizer

- Novartis

- Takeda

- Merck KGaA

- Merck

- Daiichi Sankyo

- GSK

- Bristol-Myers Squibb(BMS)

- Roche

- AVEO Pharmaceuticals

- Amgen

- AstraZeneca

- Mirati Therapeutics

- Eli Lilly

- Johnson & Johnson

- Eisai

- Hutchison MediPharma

- Kringle Pharmaceutical

Request a Sample Copy @ https://www.marketgrowthreports.com/enquiry/request-sample/103172

Emerging C-MET & HGF Inhibitors market leaders are poised to drive growth across several regions in 2025, with North America (United States, Canada, and Mexico) accounting for approximately 25% of the market share, followed by Europe (Germany, UK, France, Italy, Russia, and Turkey) at around 22%, and Asia-Pacific (China, Japan, Korea, India, Australia, Indonesia, Thailand, Philippines, Malaysia, and Vietnam) leading with nearly 35%. Meanwhile, South America (Brazil, Argentina, and Colombia) contributes about 10%, and the Middle East & Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South Africa) make up the remaining 8%.

C-MET & HGF Inhibitors Market Trends

The C-MET & HGF inhibitors market is evolving with key innovations in cancer therapeutics. A significant trend is the increasing number of combination therapies involving C-MET inhibitors. Over 30 ongoing studies are combining MET inhibitors with PD-1/PD-L1 checkpoint inhibitors, enhancing therapeutic efficacy across NSCLC, renal cell carcinoma, and colorectal cancers. These studies have demonstrated that MET inhibition can reduce tumor cell proliferation by over 45% when used in combination therapies, as opposed to 25% with monotherapy.

Precision oncology is also shaping the landscape, with molecular diagnostics playing a pivotal role in identifying MET alterations. As of 2023, more than 40% of NSCLC patients undergo molecular profiling, increasing the chances of identifying those eligible for MET-targeted therapies. Next-generation sequencing (NGS) is being widely adopted, with over 3 million cancer genomic tests performed annually across top-tier oncology hospitals.

Furthermore, patient advocacy for targeted therapies has driven regulatory bodies to prioritize approvals. In 2023, the FDA granted accelerated approval to capmatinib for MET exon 14 skipping mutations in NSCLC. This momentum continues to influence European and Asia-Pacific markets. Another notable trend is the rise in academic collaborations; over 60 global institutions are partnering with pharmaceutical firms to study MET pathways and drug resistance mechanisms. These collaborations have led to a 35% increase in publication output related to MET-HGF inhibitors in the last 12 months.

Additionally, the market is witnessing increased patent filings. More than 210 patents have been filed globally for MET-HGF related drug candidates between 2022 and 2024. With such momentum, the landscape for C-MET & HGF inhibitors is set to transform precision cancer treatment.

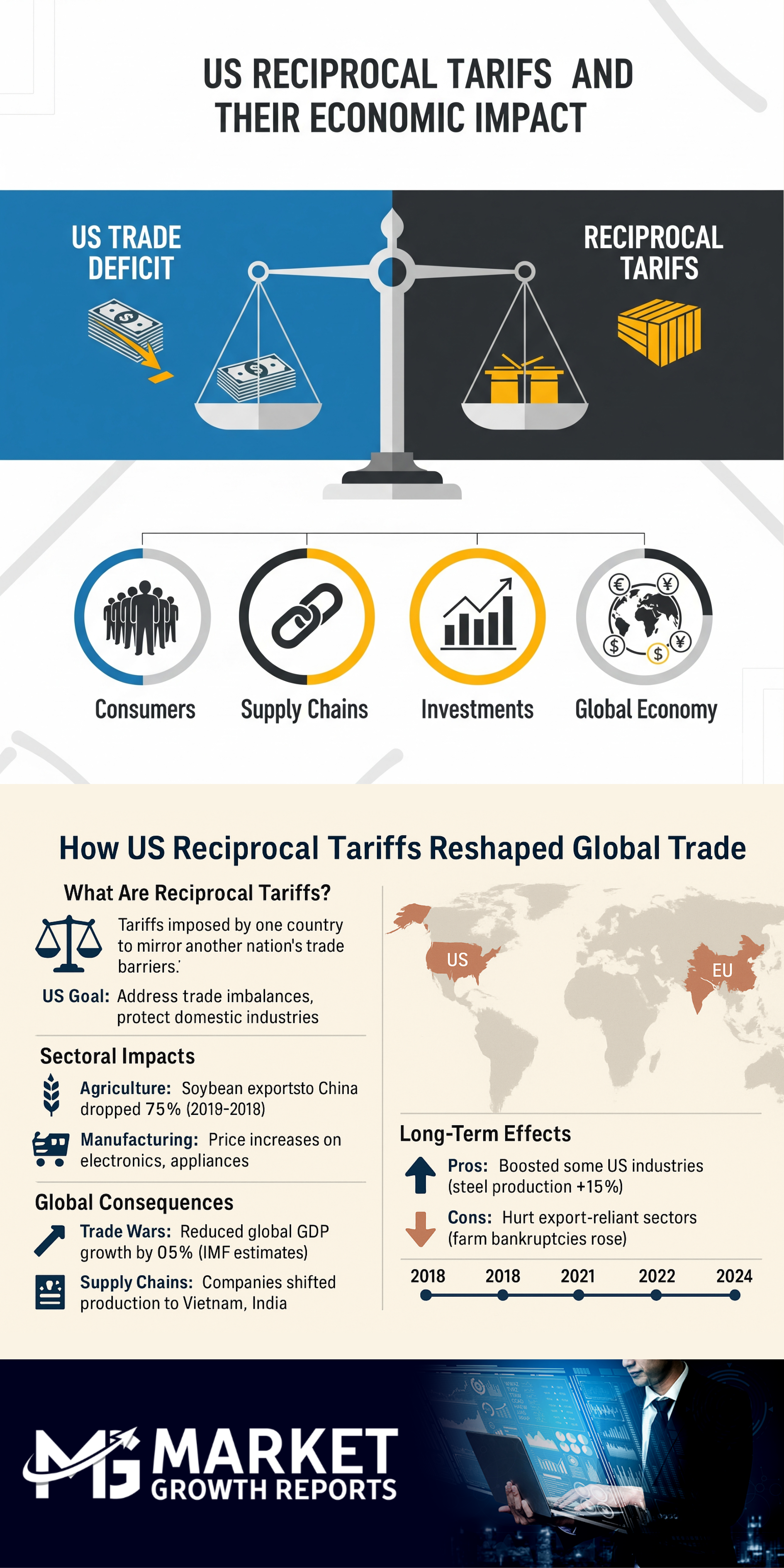

United States Tariffs: A Strategic Shift in Global Trade

In 2025, the U.S. implemented reciprocal tariffs on 70 countries under Executive Order 14257. These tariffs, which range from 10% to 50%, were designed to address trade imbalances and protect domestic industries. For example, tariffs of 35% were applied to Canadian goods, 50% to Brazilian imports, and 25% to key products from India, with other rates on imports from countries like Taiwan and Switzerland.

The immediate economic impact has been significant. The U.S. trade deficit, which was around $900 billion in recent years, is expected to decrease. However, retaliatory tariffs from other countries have led to a nearly 15% decline in U.S. agricultural exports, particularly soybeans, corn, and meat products.

U.S. manufacturing industries have seen input costs increase by up to 12%, and supply chain delays have extended lead times by 20%. The technology sector, which relies heavily on global supply chains, has experienced cost inflation of 8-10%, which has negatively affected production margins.

The combined effect of these tariffs and COVID-19-related disruptions has contributed to an overall slowdown in global GDP growth by approximately 0.5% annually since 2020. Emerging and developing economies are also vulnerable, as new trade barriers restrict their access to key export markets.

While the U.S. aims to reduce its trade deficit, major surplus economies like the EU and China may be pressured to adjust their domestic economic policies. The tariffs have also prompted legal challenges and concerns about their long-term effectiveness. The World Trade Organization (WTO) is facing increasing pressure to address the evolving global trade environment, with some questioning its role and effectiveness.

About Us: Market Growth Reports is a unique organization that offers expert analysis and accurate data-based market intelligence, aiding companies of all shapes and sizes to make well-informed decisions. We tailor inventive solutions for our clients, helping them tackle any challenges that are likely to emerge from time to time and affect their businesses.