Claroty’s $150M Series F: A Defining Moment for Industrial Cybersecurity and Critical Infrastructure Protection The industrial cybersecurity landscape has reached…

The ways Distributed Energy Startups are transforming Venture Capital Investing in Early Stage Companies. The shift in energy is a…

Speed of value creation in the current start-up environment has soared to new levels and has defied all the presumptions…

The Physical AI Revolution: Why 2026 is the Year Robotics Moves Beyond the Browser The $22 Billion Robotics Investment Surge…

The $11 Trillion Blockchain Revolution that No one Saw Coming. Since stablecoins have already enabled payment volume of over $11…

PrimeFi’s $180M Series A: Fintech Funding’s Strongroom Has Opened The crypto and fintech ecosystem has just crossed a historic inflection…

The financing winter that hit the fintech industry has left the industry unthusiastically; however, the capital is not going into…

The Rise of Tiny Teams: How Lean Startups Are Disrupting Traditional Venture Capital Models The Startup Team Size Revolution The…

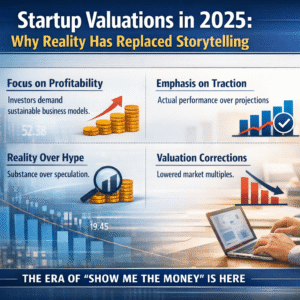

More than just exciting stories are used to build 2025 Startup Valuations. The marketplace has matured; investor expectations were redefined.…